Businesses: Opportunities and threats from red loans

Source: Bank of Greece

MEA: Non-performing credit exposures (NPEs). Loans with a delay of more than 90 days and unsecured loans without liquidation of collateral, regardless of days of delay

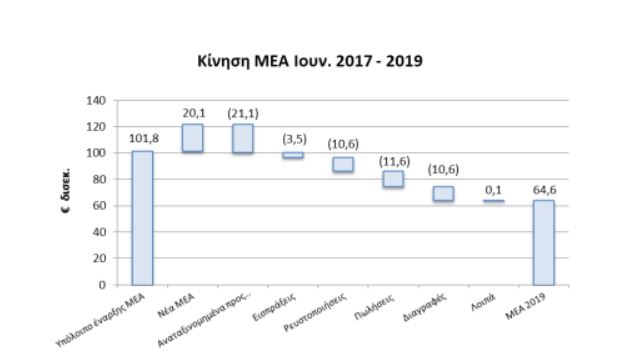

The total amount of MEAs, which in June 2017 was € 101.8 billion, decreased to 92.4 billion in March 2018 and the goal of the banks is to accelerate their reduction rate, so that in December 2019 it will reach 64.6 billion €.

The Single Supervisory Mechanism (SSM) of the ECB monitors the banks very closely and “pushes” them in order to proceed effectively to the rapid de-escalation of the problem of problem loans. In fact, it was recently announced that in the general context of the SSM strategy for the reduction of non-performing loans, each bank should set its own targets which will be monitored separately.

The basic “tools” that banks have to reduce NPEs have recently increased with the legalization of e-auctions and the out-of-court debt settlement mechanism. These new tools, combined with the increased possibilities they have for debt settlement by writing off part of them or for mass sale of loans, will be the new framework of banks’ strategy.

However, as the time horizon for achieving the target is limited, it is expected that the banks will intensify their efforts in all directions, ie either the regulation if there are the relevant conditions for viability, or the forced liquidation, or the mass sale of loans.

So we should expect: a) Stronger “will” to approve flexible restructuring plans for sustainable businesses b) Greater determination to liquidate claims through the courts and c) Increasingly “loan packages” will change hands and banks will go in the various investment funds that lately are becoming more and more.

Sustainable businesses with non-performing loans should rush to present their Business Plans to lending banks and negotiate a realistic settlement solution because they do not have much time left, the era of procrastination and waiting for more favorable regulations is over.